We polled Island businesses to find out if the outcome of the Brexit vote has changed the way they are doing business. We also asked for their predictions for the future. Tom Stroud looks at the data.

This article was first published in the July/August edition of Island Business

It’s been a year since the British people voted to leave the EU. The polling was tight (52% against 48%) and the predictions from either side were often extreme, ranging from glorious independence to financial catastrophe. So far neither has been proven to be true but that may be because Brexit hasn’t actually happened yet. Negotiations have only just begun and Britain isn’t scheduled to leave the EU until March 2019.

We wanted to know what businesses on the Island were doing in the meantime and how they felt about the future. We know that the Isle of Wight as a constituency was more pro-Brexit than most, with a strong turnout and a 62% vote in favour of Leave. Not all voters are business people though and in our recent poll of Chamber members the outcomes are less decisive.

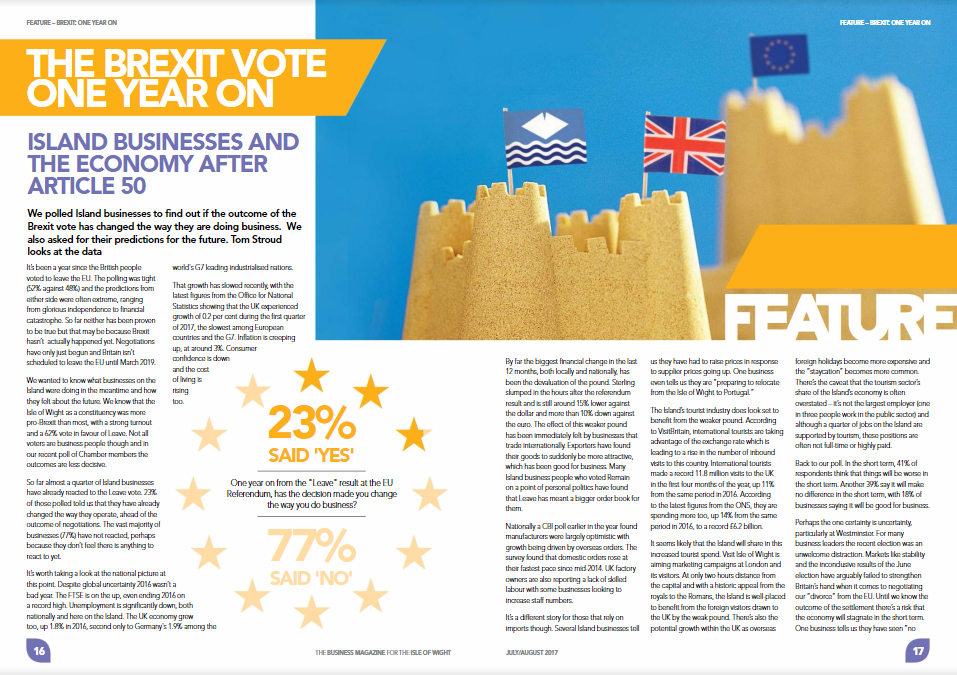

So far almost a quarter of Island businesses have already reacted to the Leave vote. 23% of those polled told us that they have already changed the way they operate, ahead of the outcome of negotiations. The vast majority of businesses (77%) have not reacted, perhaps because they don’t feel there is anything to react to yet.

It’s worth taking a look at the national picture at this point. Despite global uncertainty 2016 wasn’t a bad year. The FTSE is on the up, even ending 2016 on a record high. Unemployment is significantly down, both nationally and here on the Island. The UK economy grew too, up 1.8% in 2016, second only to Germany’s 1.9% among the world’s G7 leading industrialised nations.

That growth has slowed recently, with the latest figures from the Office for National Statistics showing that the UK experienced growth of 0.2 per cent during the first quarter of 2017, the slowest among European countries and the G7. Inflation is creeping up, at around 3%. Consumer confidence is down and the cost of living is rising too.

By far the biggest financial change in the last 12 months, both locally and nationally, has been the devaluation of the pound. Sterling slumped in the hours after the referendum result and is still around 15% lower against the dollar and more than 10% down against the euro. The effect of this weaker pound has been immediately felt by businesses that trade internationally. Exporters have found their goods to suddenly be more attractive, which has been good for business. Many Island business people who voted Remain on a point of personal politics have found that Leave has meant a bigger order book for them.

Nationally a CBI poll earlier in the year found manufacturers were largely optimistic with growth being driven by overseas orders. The survey found that domestic orders rose at their fastest pace since mid-2014. UK factory owners are also reporting a lack of skilled labour with some businesses looking to increase staff numbers.

It’s a different story for those that rely on imports though. Several Island businesses tell us they have had to raise prices in response to supplier prices going up. One business even tells us they are “preparing to relocate from the Isle of Wight to Portugal.”

The Island’s tourist industry does look set to benefit from the weaker pound. According to VisitBritain, international tourists are taking advantage of the exchange rate which is leading to a rise in the number of inbound visits to this country. International tourists made a record 11.8 million visits to the UK in the first four months of the year, up 11% from the same period in 2016. According to the latest figures from the ONS, they are spending more too, up 14% from the same period in 2016, to a record £6.2 billion.

It seems likely that the Island will share in this increased tourist spend. Visit Isle of Wight is aiming marketing campaigns at London and its visitors. At only two hours distance from the capital and with a historic appeal from the royals to the Romans, the Island is well-placed to benefit from the foreign visitors drawn to the UK by the weak pound. There’s also the potential growth within the UK as overseas foreign holidays become more expensive and the “staycation” becomes more common. There’s the caveat that the tourism sector’s share of the Island’s economy is often overstated – it’s not the largest employer (one in three people work in the public sector) and although a quarter of jobs on the Island are supported by tourism, these positions are often not full-time or highly paid.

Back to our poll. In the short term, 41% of respondents think that things will be worse in the short term. Another 39% say it will make no difference in the short term, with 18% of businesses saying it will be good for business.

Perhaps the one certainty is uncertainty, particularly at Westminster. For many business leaders the recent election was an unwelcome distraction. Markets like stability and the inconclusive results of the June election have arguably failed to strengthen Britain’s hand when it comes to negotiating our “divorce” from the EU. Until we know the outcome of the settlement there’s a risk that the economy will stagnate in the short term. One business tells us they have seen “no changes yet but all capital projects such as building industrial units for rental are on hold.” Another fears that any gloom will be self-perpetuating, telling us that “People have no direction or clue what will happen with their money and circumstances so they are very wary of how they are spending money, hence business is significantly down. Media and government need to work to put a positive spin on this situation or a bad Brexit will become a self-fulfilling prophecy.”

In the long term Island businesses predictions about Brexit are more pronounced, with only 23% of businesses predicting no impact at all. 45% of respondents expect a negative effect, with 32% predicting a positive effect. Much will depend on the terms of the Brexit settlement, but many businesses are telling us they are preparing to cut back, particularly those companies that have relied on EU funding. One tells us that “We are making cuts and looking at how to run a much smaller enterprise. There will be job losses. We now know that some 25% of potential funding will cease. That along with the general recession has seen a downturn in income.”

That said, although 45% of businesses think that leaving the EU will be bad news in the long term, there’s a collective majority of 55% that think things will stay the same or improve. Financial disaster or economic opportunity? Perhaps the truth is it’s still too early to tell. The marketplace has certainly changed since the referendum and the way businesses react to those changes will help to define what happens next. It’s still almost another two years until Brexit actually happens. Economies are built on faith in the future. Who will you believe?

One year on from the “Leave” result at the EU Referendum, has the decision made you change the way you do business?

YES 24 %

NO 76 %

In the short term how do you think the UK’s decision to leave the EU will affect your business?

Positively 19 %

Negatively 40 %

No impact 38 %

No response 2 %

In the long term how do you think the UK’s decision to leave the EU will affect your business?

Positively 33 %

Negatively 45 %

No impact 21 %

From the polls:

“We are doing more business in the Euro zone than before. The weaker pound is helping exports on one hand and increasing costs of imports on the other. We need to just get on with it. Stop faffing about and when the pound settles at around £1.20 all will be good.”

“The brand of Britain has taken a dent – we look like idiots. We will recover but the long term net is very likely to be negative based on the international attitude and damage to good will.”

“As a farm business we can only wait to see how appreciative the Government is of our contribution to the country and the economy and how we will be supported after Brexit. Some farmers had a problem with EU red tape -as a business we have always been in favour of good standards and traceability. I am sure the UK will adopt the same standards but without the EU subsidy!”

“Unless the single market, access and freedom of movement are preserved, Brexit will be a spectacular train crash. I totally lack the faith that some Brexiters seem to have. Possibly they are not economists and have given little consideration to the true impact. I believe that if we wanted to live on an unhappy, disunited offshore island there is no better way than this to achieve it. Ultimately it could mean declining business opportunity and a pretty miserable existence for all.”

“There’s no direct impact, but our work tends to be dependent on the construction and housing market, so if that is generally affected by Brexit it could ultimately have an effect on us. At this stage I don’t think it’s possible to predict whether that would be positive or negative.”